Navigating the Aftermath: Understanding Tax Relief in Florida Following a Hurricane

Related Articles: Navigating the Aftermath: Understanding Tax Relief in Florida Following a Hurricane

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Aftermath: Understanding Tax Relief in Florida Following a Hurricane. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Aftermath: Understanding Tax Relief in Florida Following a Hurricane

Florida, renowned for its sunny beaches and vibrant culture, is also a state susceptible to hurricane activity. The potential for devastating storms necessitates careful preparation and recovery strategies. In the wake of a hurricane, financial assistance becomes crucial, and Florida offers a vital lifeline through hurricane tax relief measures.

Understanding Hurricane Tax Relief

Hurricane tax relief refers to a range of tax-related provisions implemented by the state of Florida to alleviate the financial burden on residents and businesses affected by hurricanes. These provisions aim to provide much-needed relief during the recovery process, enabling individuals and organizations to rebuild their lives and communities.

Key Aspects of Florida’s Hurricane Tax Relief

Florida’s hurricane tax relief measures typically encompass several key aspects:

- Tax Filing Deadlines: The state may extend tax filing deadlines for individuals and businesses affected by hurricanes. This extension provides valuable time for taxpayers to gather necessary documentation and address their tax obligations without facing penalties.

- Property Tax Relief: Property owners may be eligible for property tax relief, such as reduced assessments or exemptions, if their property was significantly damaged by a hurricane. These measures can offer significant financial assistance during the rebuilding process.

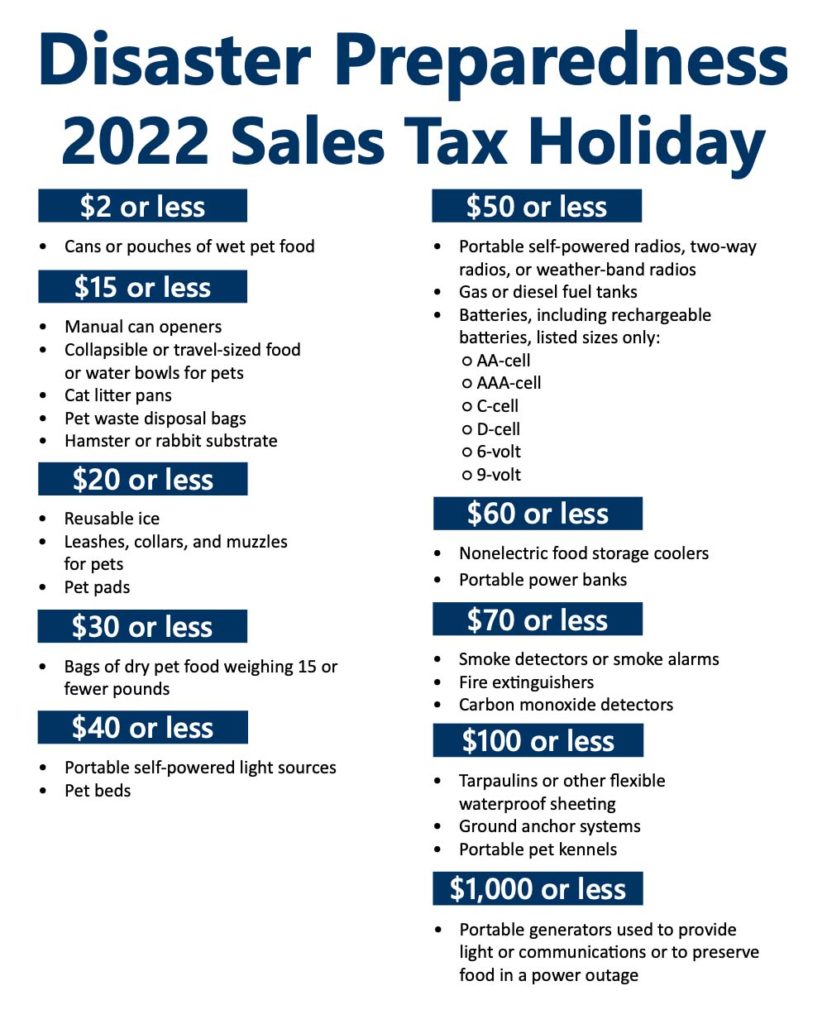

- Sales Tax Relief: The state may waive sales tax on certain essential items, such as building materials, generators, and cleaning supplies, to help residents acquire necessary goods for recovery.

- Income Tax Relief: Individuals and businesses may receive income tax relief, including deductions or credits, for hurricane-related losses. This can significantly reduce their tax liability and provide more financial resources for recovery.

- Disaster Unemployment Assistance: Individuals who lose their jobs due to a hurricane may be eligible for disaster unemployment assistance, providing temporary income support while they seek new employment.

Navigating the Relief Process

To access hurricane tax relief benefits, individuals and businesses need to follow specific procedures:

- Verification of Eligibility: It is crucial to verify eligibility based on the specific hurricane event and the applicable relief measures. This often involves documentation demonstrating the impact of the hurricane on the individual or business.

- Documentation Requirements: Specific documentation may be required to support claims for tax relief, such as proof of residency, damage assessments, and financial records.

- Application Process: Individuals and businesses typically need to file applications or submit documentation through designated channels, such as the Florida Department of Revenue or the Florida Division of Emergency Management.

Importance of Hurricane Tax Relief

Hurricane tax relief plays a vital role in the recovery process, offering several significant benefits:

- Financial Support: Tax relief provides much-needed financial assistance to individuals and businesses struggling to recover from hurricane damage. This support can help cover expenses for repairs, rebuilding, and essential needs.

- Stimulating Economic Recovery: By reducing tax burdens, hurricane tax relief can stimulate economic activity in affected areas, encouraging businesses to rebuild and residents to invest in their communities.

- Easing Financial Stress: Tax relief measures can ease the financial stress associated with hurricane recovery, allowing individuals and businesses to focus on rebuilding their lives and livelihoods.

Related Searches

Understanding the intricacies of hurricane tax relief requires exploring related searches to gain a comprehensive perspective:

1. Florida Hurricane Tax Relief 2024: This search focuses on the specific tax relief measures available in 2024 following a hurricane. It may include information on deadlines, eligibility criteria, and application procedures.

2. Hurricane Tax Deductions Florida: This search delves into potential tax deductions available for hurricane-related expenses. It may cover deductions for property damage, lost income, and charitable contributions.

3. Florida Hurricane Tax Relief Forms: This search helps individuals and businesses find the necessary forms and documentation for applying for hurricane tax relief.

4. Hurricane Tax Relief for Businesses Florida: This search specifically targets businesses affected by hurricanes, highlighting tax relief measures tailored to their needs, such as business property tax relief and sales tax exemptions.

5. Florida Hurricane Disaster Relief: This search explores a broader range of disaster relief programs available in Florida, including federal and state assistance, beyond just tax relief.

6. Hurricane Damage Tax Relief: This search examines tax relief options available for various types of hurricane damage, including property damage, business interruption, and personal injury.

7. Hurricane Insurance and Tax Relief: This search explores the interplay between hurricane insurance and tax relief, focusing on how insurance payouts and tax deductions can be combined to maximize recovery efforts.

8. Florida Hurricane Tax Relief Hotline: This search aims to find contact information for hotlines or resources offering assistance and guidance on navigating hurricane tax relief programs.

FAQs

1. What are the eligibility requirements for hurricane tax relief in Florida?

Eligibility requirements vary depending on the specific tax relief program and the hurricane event. Generally, individuals and businesses must demonstrate that they were directly affected by the hurricane, such as experiencing property damage or economic loss.

2. How do I apply for hurricane tax relief in Florida?

The application process varies depending on the specific program. Typically, individuals and businesses need to file applications or submit documentation through designated channels, such as the Florida Department of Revenue or the Florida Division of Emergency Management.

3. What documentation do I need to provide for hurricane tax relief?

Required documentation may include proof of residency, damage assessments, financial records, insurance policies, and other relevant documents demonstrating the impact of the hurricane.

4. What are the deadlines for applying for hurricane tax relief?

Deadlines vary depending on the specific tax relief program and the hurricane event. It is crucial to consult official sources or contact relevant agencies for the latest deadlines.

5. Can I receive hurricane tax relief if I have insurance coverage for the damage?

Yes, you may still be eligible for tax relief even if you have insurance coverage. However, the amount of tax relief may be reduced by the amount of insurance proceeds received.

6. What if I am a business owner affected by a hurricane?

Businesses may be eligible for specific tax relief programs, such as property tax relief, sales tax exemptions, and business income tax deductions.

7. Are there any federal tax relief programs available for hurricane victims?

Yes, the federal government offers various disaster relief programs, including tax deductions for hurricane-related losses and disaster unemployment assistance.

8. Where can I find more information about hurricane tax relief in Florida?

You can find detailed information on the Florida Department of Revenue website, the Florida Division of Emergency Management website, or by contacting relevant agencies or organizations.

Tips for Navigating Hurricane Tax Relief

- Keep Records: Maintain detailed records of all hurricane-related expenses, including receipts, repair estimates, and insurance documentation.

- Consult with Professionals: Seek guidance from tax professionals or financial advisors to understand your eligibility and navigate the application process.

- Act Promptly: Apply for tax relief promptly after the hurricane event to avoid missing deadlines.

- Stay Informed: Monitor official sources for updates on tax relief programs, deadlines, and eligibility criteria.

- Contact Relevant Agencies: Do not hesitate to contact the Florida Department of Revenue, the Florida Division of Emergency Management, or other relevant agencies for assistance.

Conclusion

Hurricane tax relief plays a crucial role in helping Florida residents and businesses recover from the devastating impacts of hurricanes. By understanding the available programs, eligibility requirements, and application processes, individuals and organizations can navigate the relief process effectively and access the financial support they need to rebuild their lives and communities. It is essential to stay informed, act promptly, and seek guidance from qualified professionals to maximize the benefits of hurricane tax relief in Florida.

/hurricane-ian-update-092722-2-694a964d68064c1ea2da46cbd172bf54.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Aftermath: Understanding Tax Relief in Florida Following a Hurricane. We thank you for taking the time to read this article. See you in our next article!